How To Write Off Accounts Receivable In Quickbooks For Mac

• Select the Account field and select Accounts Receivable. • Enter the amount under Credit column, tab to the Name column and select a Customer Name from the drop down list. • In the next line, select the offset account and enter the amount under Debit column.

From the receive payments window, select the invoice to be written off, click on discount. From the discount window enter the amount to be written off and select 'bad debt expense' as the account. This write-off method will not adjust the liability included for sales tax on the invoice. Writing off bad debt does not mean you need to stop trying to collect. It is just a way of preventing you from paying too much in taxes. If a debt you have written off is paid later, credit the Bad Debt Expense account instead of an income account to record the payment.

• Select Save & Close. • Apply the General Journal Entry to the Existing Credit/Debit. • From the Customers menu, select Receive Payments. • Enter the name of the customer in Received From field.

• Select the invoice and choose Discounts & Credits. • Under Credits tab, select the available credit and click Done. • Select Save & Close. Accounts Payable. • Select the Account field and choose Accounts Payable from the drop down list.

• Enter the amount under Debit column, tab to Name column and select the vendor name from the drop down list. • In the next line, select the offset account and enter the amount under Credit column. • Select Save & Close. • Apply the journal entry to the existing debit/credit. • From the Vendors menu, select Pay Bills. • Select the bill and choose Set Credits.

Download and install vlc media player for mac. • Under Credits tab, select the available credit and click Done. • Select Save & Close. Option 2: Use Discounts to write off small amounts • Create an account and item to use when writing off small amounts.

• Create a Charge off Account. • From the Lists menu, choose Chart of Accounts. • Select the Account button and choose New. • Select Income then Continue. • Enter Minor A/R and A/P Charge-Off in the Account Name field and select Save & Close.

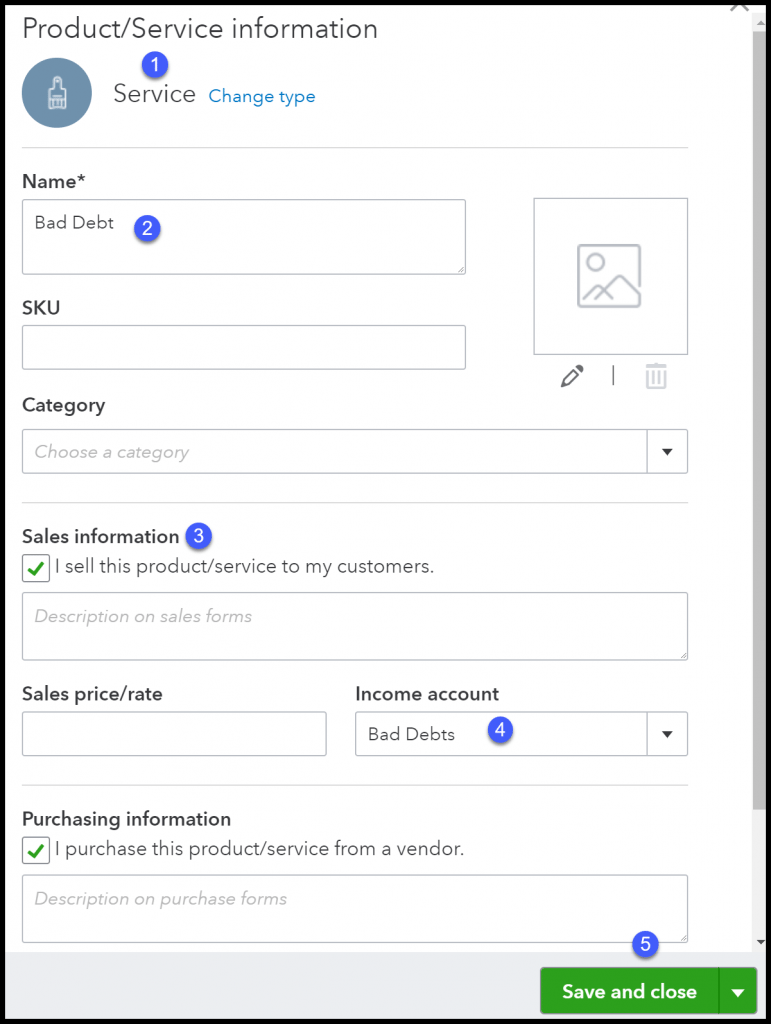

• Create a Charge-off item. • From the Lists menu, choose Item Lists. • Select the Item button and choose New.

• Choose Other Charge as Item Type and click Continue. • Enter Minor Charge-Off in the Item Name/Number field. Quickbooks for mac 2017 tutorial. • Select Non-Taxable Sales in the Tax Code field.

• Select Minor A/R and A/P Charge-Off in the Account field. • Select OK to save and create the item. • Select the scenario that best describes the small amount that you want to clear.

• Enter a Bill that will offset the credit. • From the Vendors menu, choose Enter Bills. • Select the vendor in the Vendor field.

• Under the Items tab, select Minor Charge-Off in the Item field. • Select Save & Close • Apply the available credit to the bill that you created.